Gold's qualities make it one of the most coveted metals globally and a popular gift in the form of jewelry. But what makes this precious metal ideal for your investment portfolio? There are many reasons, and we will outline the best ten reasons to invest in gold in this article.

You should ask yourself if you should include gold in your investment or retirement plan.

Here's a list of 10 reasons why it could make sense to invest in gold:

1. Gold protects against uncertainty.

Gold retains its value not only in times of financial uncertainty but also in times of geopolitical uncertainty. Investors look for gold significantly when global tensions increase.

And let's face it; the world is heading fast to uncertainty due to the covid pandemic, the massive increase in debt, and political tension between the countries.

2. Gold is a finite commodity.

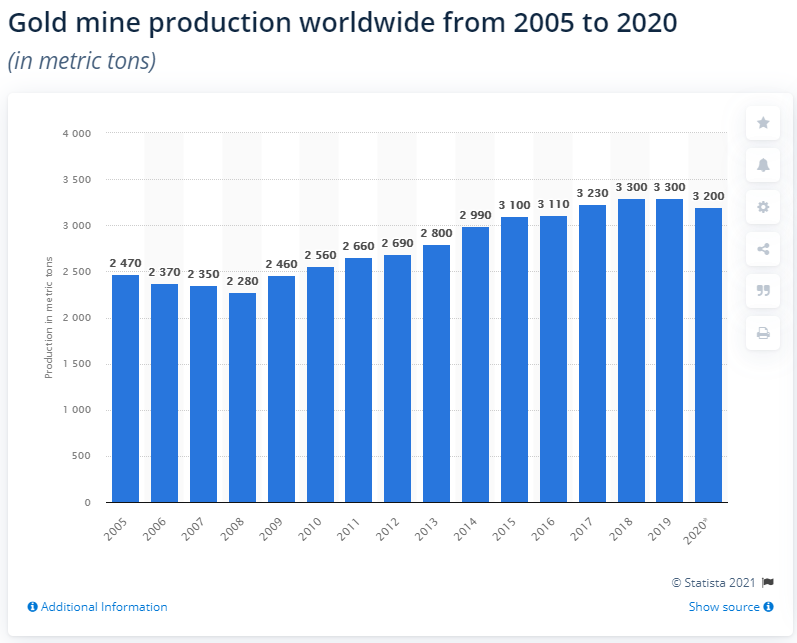

It isn't easy to extract gold, and it takes years to set up a mine. The reduction in supply can drive up the price of gold.

Gold is scarce and finite – another reason why it's so highly valued. Exploration budgets for mines are shrinking as mining costs are rising. With lower annual gold production and increasing demand, gold prices consistently rise.

Check in the chart below from Statista that gold mine production increased slowly, with a sharp decline in 2020.

3. Gold demand is increasing.

In past years, emerging market economies' rising wealth has stimulated gold demand.

In many countries, gold is intertwined with culture. India is one of the largest gold-consuming nations in the world. Gold jewelry ownership is so widespread in India that, as of 2016, Indian households owned more gold than the top six central banks combined.

One of the most significant factors driving the gold price is the Love Trade, or the seasonal gift-giving of gold jewelry prominent in China and India, the two largest bullion consumers.

With rapidly growing middle classes, demand is expected to rise even further. Given the price increase, demand for gold has also grown among many investors who are beginning to see commodities, particularly gold, as an investment class into which funds should be allocated.

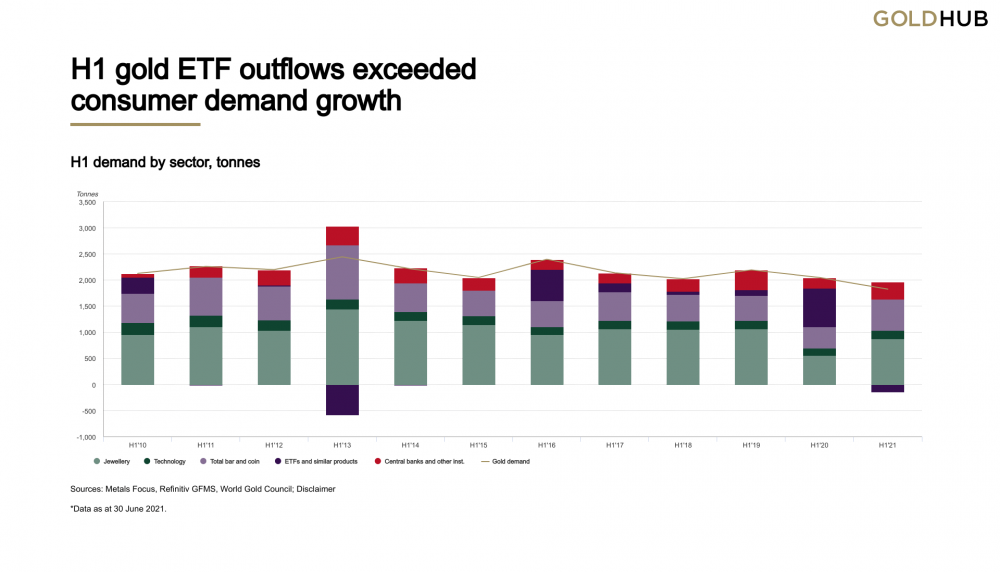

4. Investors want it

Demand for gold has also increased among fund and ETF investors. In just four years, the SPDR Gold Trust (gold) has become one of the largest ETFs in the United States.

5. Diversification of investment portfolio

Diversifying means having investments that are not too interrelated. Having an asset that tends to increase in value during crises is crucial.

Historically, gold has reduced losses during periods of economic distress or instability in the markets and helped to improve portfolio risk-adjusted returns. It is a mainstream asset as liquid as other financial securities, and its correlation to major asset classes has been low in both expansionary and recessionary periods.

The key to diversification is finding investments that are not closely correlated to one another. Combining gold with equities and bonds in a portfolio reduces overall volatility and risk.

6. Protects against inflation

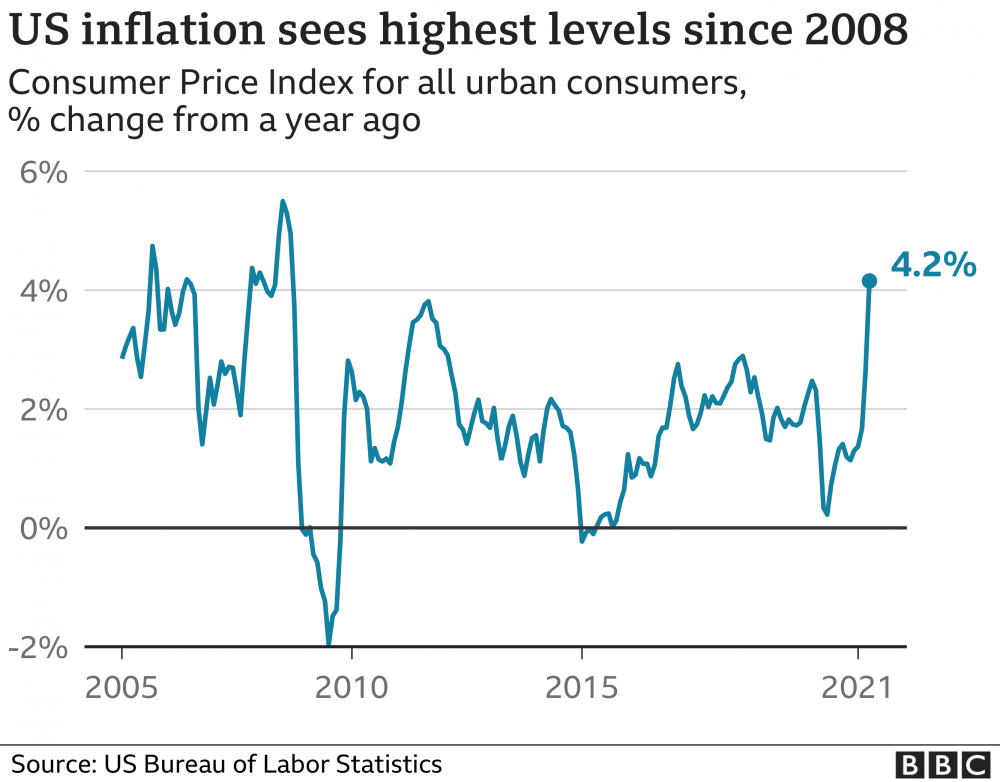

According to BBC, consumer prices jumped 4.2% in the 12 months to April, up from 2.6% in March and marking the most significant increase since September 2008.

Gold has historically been an excellent hedge against inflation because its price tends to rise when the cost of living increases. As the dollar decreases in value during this time, inflation eats away at cash and Treasury yields, making them less attractive as safe-haven assets, leading many investors to gold. Over the past 50 years, investors have seen gold prices soar and the stock market plunge during high inflation years.

7. Maintains its value

Since the discovery of gold thousands of years ago, it has been a coveted commodity and store of value. Although global currencies are no longer backed by gold, it remains highly valued, particularly during economic downturns when many other assets depreciate.

Gold has maintained its value throughout the ages, unlike paper currency, coins, or other assets. Investors see gold as a way to pass on and preserve their wealth from one generation to the other.

8. You don't pay VAT on gold (unbelievable but true).

In addition to not paying VAT, you do not pay taxes until you sell it for a capital gain.

9. Bullion is seen as a haven during times of political instability.

Just as investors flock to bullion during financial instability, many do so during rising world tensions and geopolitical turmoil.

For this reason, gold is sometimes called the "crisis commodity," Its price often appreciates the most when confidence in governments is low.

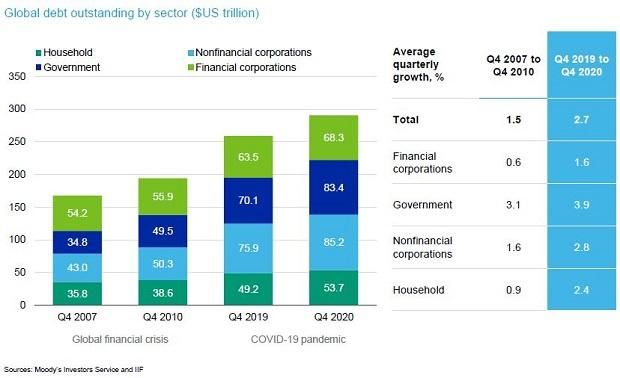

10. Global government debt is skyrocketing.

Total global debt is at an all-time high, with around $120 trillion added since 2008. Another financial crisis could be in the works due to the growing risks of such large deficits.

Savvy investors and savers might see this as a sign to allocate a part of their portfolios in "haven" assets that have historically held their value in times of economic contraction, such as gold.

Downsides of investing in Gold

This article will not be complete if we do not briefly explain several downsides of investing in gold.

So here are:

- Harder to transform in fiat - If you have a big bar of gold is difficult to sell parts of it and cash out immediately.

- NoDividends - Gold is not profitable, so it does not produce dividends or wealth.

- Can't hedge the markets - Unfortunately, the gold price did not always go up when the markets were going down in the past.

Check our guide on the PROs and CONs of investing in gold.

Conclusion

Gold benefits a well-diversified investment portfolio, given its price increases in response to various events causing paper investments, such as stocks and bonds, to decline.

Although the price of gold can be volatile for a while, it has always maintained its value over the long term. It has served as a trusted hedge against inflation and the erosion of major currencies throughout the years, thus being an investment worth considering.

Ready to invest in Gold? Check our guide on how to get in gold this year.

Tell us in the comments below if you consider GOLD in your investments portfolio or have questions. I will gladly answer.

Further readings: