People have made large amounts of money trading cryptocurrencies and continue to do so. This doesn’t mean cryptocurrencies trading is easy and effortless.

There is a chance you will end up losing money, you might end up losing all of it, but with the right strategies you can certainly minimize risk and end up with nice profits.

If you have some money lying around, you too can get started in no time with as little as you like.

It’s never too late to start cryptocurrencies trading. You need to be strategic, patient, able to research and analyze market trends. As a rule of thumb - never invest what you cannot afford to lose.

#1 - Get Bitcoin

In order to start trading cryptocurrencies, you will first need to buy some bitcoins. That's because most of the exchange companies you will use to trade accept payments in Bitcoin, BitcoinCash or Ethereum.

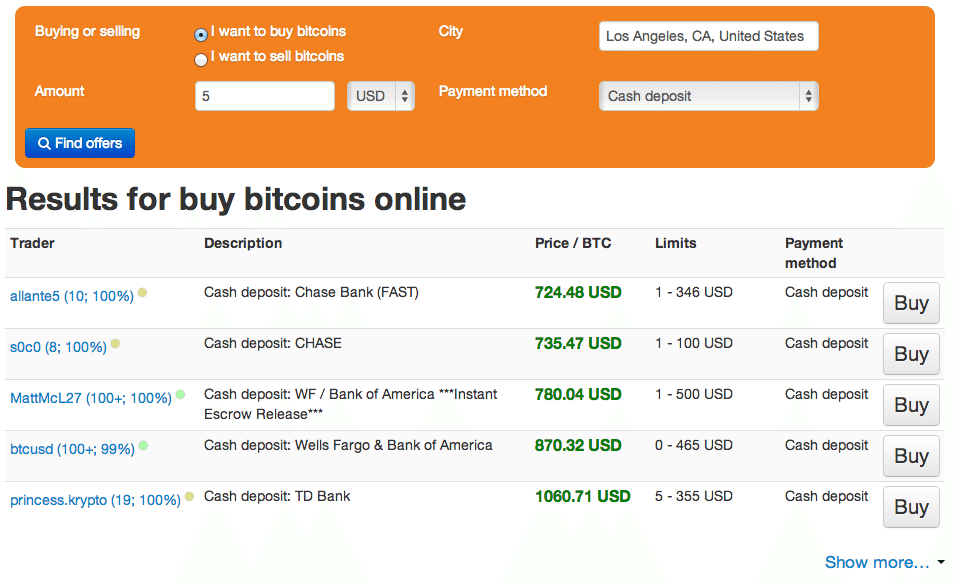

The best way to do it is through a bitcoin local exchanger in your country. In the US, exchanges like Coinbase, CoinMama and Kraken are go-to for most people. You can check exchanges in your country here. If there is no bitcoin exchange in your country, you could always use localbitcoins.com and buy bitcoin from other people.

Localbitcoins is an escrow service which helps to match buyers and sellers. You can either pay the seller by cash or bank transfer. Most of the sellers advertise whichever payment method they prefer.  Remember: You don’t have to buy a whole bitcoin ($11900 as of writing); you can purchase bitcoin in fractions known as Satoshis. For instance, 100k Satoshis is equal to 0.001 bitcoin. Now that you have some bitcoin, it’s time to transfer them to a trading exchange.

Remember: You don’t have to buy a whole bitcoin ($11900 as of writing); you can purchase bitcoin in fractions known as Satoshis. For instance, 100k Satoshis is equal to 0.001 bitcoin. Now that you have some bitcoin, it’s time to transfer them to a trading exchange.

There are many exchanges, but the most popular and reliable ones are Bittrex and Poloniex. There other cryptocurrencies you should look into like for instance, Ethereum.

#2 - Prerequisites for Trading

Before you start investing your hard earned money in other cryptocurrencies, there are a few things to keep in mind:

Research

Before placing a trade you must do an in-depth research on the coin you want to invest in. The best starting point is the announcement page of the coin.It shows all the important information you need to know: total coin supply, technical details, development plans, mission statement, community speculation, and a lot more.

Just google “coin-name ann” and go to bitcointalk.org forum announcement thread.

CoinMarketCap.com is another good source of information as you will see all the crypto-coins listed along with market details, past time evolution etc.

Other threads you can find information about crypto-currencies are: Top Gold Forum and InvestOpen.com

It is highly recommended to read the whitepaper (usually available on the coin’s official website). Join their team on slack and ask them questions in case you have any. You’ll be surprised to see how engaging these communities are.

Stay updated

News in the crypto world spreads like fire. Thanks to Twitter, Reddit, Telegram and crypto-specific news website, you can stay up to date with what’s going on.

Pay close attention to the news on Twitter in particular and make sure they are from reputed sources.

Learn to ignore biased sources and rumors. This is where pump and dump schemes take place; people post misinformation on websites and hope for people to fall for it. Recently, the hoax of Vitalik Buterin’s (founder of Ethereum) death started spreading from 4chan, which in turn crashed Ethereum price and wiped out $4 billion in Ethereum’s market value.

Don’t let these people get you; seek advice from trusted and unbiased sources, and make your investing decisions accordingly.

Set achievable goals

Cryptocurrency trading is not one of those get-rich-quick schemes. Set a realistic plan of return on your investment, it could be 5%, 10% or 20%. This market is very volatile.

If you don’t stick to your expected returns, you’re bound to panic and make mistakes. As the crypto veterans will tell you, setting up realistic long-term goals (2-5 years) will take you a long way in cryptocurrency trading.

#3 - Begin trading

You’re all set to trade. By doing your research, gain the right information at the right time and understand how it will interact with the market. This will help you predict trends - whether or not the coin will rise.

Also, look out for any technical analysis on the coin - study charts and find patterns. In a nutshell, this is exactly what you need to do - buy low, sell high. If the price of a coin you’ve bought goes up quickly, cash out into bitcoin and buy back again once the price goes down.

If it’s a coin that you really believe in - you’re confident of the idea, tech, and team - you’d want to hold on to that coin long-term because a good coin will always rise back up again. Now we get to trading. Here are some of the exchanges that you can trade on.

Each exchange has it's own nuances and rules, so be sure you understand them before trading any significant amount of money. For example, you don't even have to set up an account at ShapeShift. It feels weird in the beginning, but after the first transaction, it makes total sense.

There are a lot of apps that can help you track all your crypto investments. My personal favorite is Blockfolio, available for both Android and iOS. It has major exchanges integrated into it and almost all the coins.

Lastly, greed can be extremely dangerous in trading. The more patient you are, the better you will do. Period.

No one knows what will happen to the markets tomorrow. Doesn’t matter how experienced of a trader you are, you will make some mistakes and lose money.

Learn from those mistakes, get back up and make sure not to repeat them.

#4 - Takeaways

Investing in cryptocurrencies is a fun ride. There are a lot of ups and downs. The community is super active and always willing to help you out.

Like I said in the beginning, always invest within your means. No need to sink your life savings in crypto trading. We are most likely living in a bubble which could burst at any time.

Don’t overreact when the market is doing good and panic when it is down. Learn what affects the bitcoin market growth.

Take it slow. Do your research before investing and most importantly, have fun trading.