All Activity

- Past hour

-

Boosting Trust for Your Facebook Account Hey there, LuxAccs here! The level of trust Facebook places in your account impacts various aspects, such as moderation speed, frequency of checks, and placement in advertising auctions. In this post, we'll explore different strategies to enhance Facebook's trust in your account. Let's dive in! Here are some methods to increase your accounts’ trust levels: Warming up accounts. Regular non-advertising activity helps warm up accounts, reducing the risk of suspension and increasing trust; Complying with community rules. Adhering strictly to Facebook's advertising policy and ensuring that creatives align with platform guidelines will enhance trust. You can review the advertising policy through this link; Using unique promo materials. Avoid directly copying competitor bundles via spy services, as algorithms may flag such activity as suspicious; Employing WhitePage landings. When promoting gray-hat offers, make sure you have high-quality white-hat pages that resemble local business websites; Linking to agent accounts. Connecting your account to agent accounts enhances trust, as they are registered under legal entities. You can purchase an agent account without promotion restrictions at LuxAccs! We provide high-trust accounts at competitive prices. Our contact info: Website TG channel Sales department Instagram

- Today

-

[Sell] 🎯 GoogleADS Accounts + Balance + Spend

PirateAds replied to PirateAds's topic in Digital Accounts

🔥 Google Ads Accounts with Balance in stock: 🇨🇦 Prepaid Balance CA$600 ($435) + Promo Code CA$600 + Spend 🇨🇦 Prepaid Balance CA$600 ($435) + Promo Code CA$600 + Spend 🇨🇦 Prepaid Balance CA$600 ($435) + Promo Code CA$600 + Spend 🇨🇦 Prepaid Balance CA$450 ($328) + Promo Code CA$600 + Spend 🚀 Ready To Run! 🧨 High Trusted Accounts with Prepaid Balance. 💳 Linked Real Credit Card with High Credit. 🎁 A promo code for CA$600/$500 has been activated. 🌎 Suitable for launching in any Сountry. ✅ Farmed Manually, on Real Mobile Devices and Quality Mobile Proxies (Proxy included). 🔥Auto-sell Bot https://t.me/PirateAds_Bot ❗Escrow +++ -

Crypto exchange platforms have become a major business model all over the world. The demand for exchange platforms continuously arises due to their increasing user base. However the question “how to increase the liquidity of exchange platforms” has become a major discussion topic all over the world. Liquidity is an important factor for a crypto exchange platform as it ensures a smooth order execution and slippage minimization. Exchanges can partner with market makers. Through continuous price quotes for specific assets, these market makers can provide liquidity. Exchanges can ensure consistency of liquidity on their platform by incentivizing market makers through rebates or other arrangements. Offering diverse trading pairs can attract different types of traders and increase overall liquidity. Popular pairs like BTC/USD or ETH/BTC are essential but don’t neglect smaller altcoin pairs. Remember that each pair contributes to the overall liquidity pool. By offering liquidity incentives to traders, the overall liquidity of your exchanges can be boosted significantly. This can take the form of maker/taker fee structures, where makers (those who add liquidity to the order book) are rewarded with lower fees or even rebates. In addition to that, exchange platforms can run promotional campaigns or competitions to encourage trading activity and liquidity provision. Including stablecoins as base or trading pairs can improve liquidity since they have higher trading volumes and lower price volatility compared to other cryptocurrencies. Stablecoins act as a safe place for traders during times of market uncertainty which results in overall trading activity. A robust trading engine and efficient matching algorithm are essential for maintaining liquidity, especially during periods of high trading volumes. By optimizing order execution speed and minimizing latency, exchanges can attract high-frequency traders and market makers, thus enhancing liquidity. Stay updated on market trends and adjust trading pairs or liquidity incentives according to it. By analyzing trading volumes, order book dynamics, and user behavior, exchanges can fine-tune their liquidity strategies to meet the changing market demands. Maintaining a vibrant and engaged community around your exchange can indirectly contribute to liquidity. By organizing events, webinars, and educational resources, exchanges can empower traders with knowledge and skills that will encourage them to actively participate in the market and contribute to liquidity. It is always important to remember that ensuring sufficient liquidity on your crypto exchange platform requires a multiple approach and strategies. As you work toward ensuring liquidity on your crypto exchange, consider partnering with a reputable cryptocurrency exchange development company. These specialized firms understand the complexities of exchange platforms and help you to create a successful exchange that benefits both traders and liquidity providers.

-

Gold Price (XAU/USD) Is Testing an Important Resistance Zone On April 16, we wrote why the $2,380 zone is an important resistance area. The XAU/USD chart shows that: 1) After fading fluctuations (they formed a narrowing consolidation triangle - shown in green), the price of gold dropped sharply (shown by a black arrow) on April 22-23. 2) Then, the price found support in the form of the lower border of the ascending channel (shown in blue), which has been in effect since the beginning of March. This led to the formation of another consolidation pattern between the blue lines. 3) An upward breakdown of the red lines on May 9 could be interpreted as an attempt by the bulls to resume the upward trend within the blue channel, but we could expect that the green triangle with its axis around 2380 would provide resistance. TO VIEW THE FULL ANALYSIS, VISIT THE FXOPEN BLOG Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

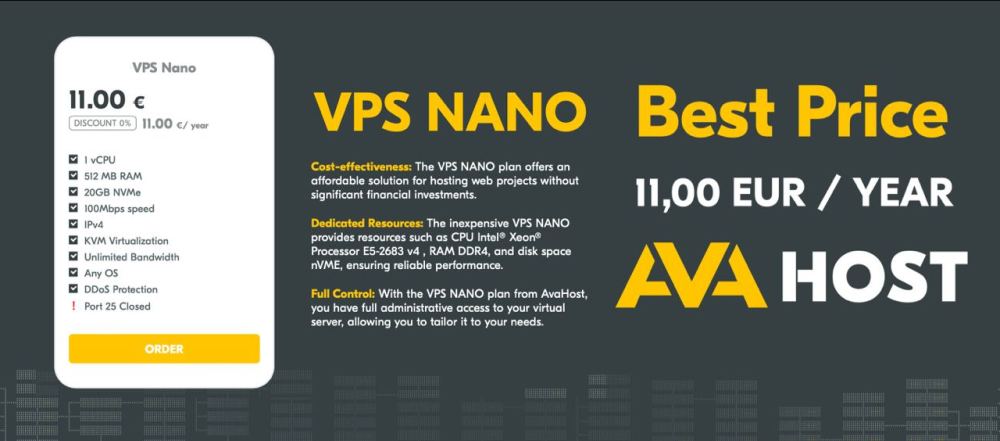

🚀 Introducing the new VPS NANO plan from AVA.HOSTING (https://ava.hosting/)! 🚀 👉 Already on our website: https://ava.hosting/vps/vps-nano/ Exclusive Offer! Our new VPS NANO plan is something unprecedented on the internet, and we guarantee its uniqueness! 💸 Cost-effectiveness: The VPS NANO plan offers an affordable solution for hosting your web projects without significant financial investments. Just 11.00 EUR per year! 🔧 Dedicated Resources: Despite its low cost, you get reliable resources including an Intel® Xeon® Processor E5-2683 v4, DDR4 RAM, and NVMe disk space. 🔑 Root Access: The VPS NANO plan gives you full administrative access to your virtual server, allowing you to tailor it to your needs. 🤔 Still have doubts? Place your order, and all doubts will be dispelled! 🔗 Learn more or purchase the plan on our website: https://ava.hosting/vps/vps-nano/ 🟡 AVA.HOSTING (https://ava.hosting/) - your reliable hosting forever! 🌐

-

official Market Update by Solidecn.com

Solid ECN ✔️ replied to Solid ECN ✔️'s topic in Forex News & Analysis

Franc Strengthens, Dollar Weakens Post-Fed Solid ECN—The Swiss franc has remarkably recovered, climbing to 0.91 against the US dollar from a seven-month low of 0.92 on May 1st. This rebound was sparked by unexpectedly high inflation data, which reduced the market's expectation that the Swiss National Bank (SNB) would further relax monetary policy. In April, inflation surged to 1.4% from a low of 1% the previous month, significantly exceeding forecasts of 1.1%. Inflation Concerns Shape Policy The recent jump in inflation rates is noteworthy, especially since the SNB had warned that prices could be unstable due to global tensions and a relaxed stance on the franc. Although foreign currency reserves have increased, the rapid inflation has fueled worries about potential ongoing price rises. These concerns have led to speculation about whether the SNB will reduce interest rates again in June. Dollar's Influence on the Franc A weakening US dollar bolstered the franc's strength after the Federal Reserve avoided strong indications of future rate hikes. This backdrop provides a complex landscape for forex traders and investors, suggesting a cautious strategy approach. -

Exploring Alltoscan: A New Player in the DeFi Space

Aurora.. replied to Smilezcryt's topic in Crypto Earning & GPT

I'm heavily invested in Alltoscan. Honestly, I'm blown away by what the team is doing. Unlike Etherscan and similar platforms, Alltoscan doesn't just focus on Ethereum transfers. It actually tracks transactions on 9 different networks, which is incredibly handy. And their infrastructure service? It makes it a breeze for developers to create projects within the Alltoscan ecosystem. With the upcoming listing on Bitget, I see big things ahead for Alltoscan. -

Bulk-discount on Proxy-Seller! 🛍 Greetings to all users of Proxy-Seller service! We are launching a new promo code, It is active for all Static Proxies on the site - ISP, IPv4 and IPv6. 📣 Promo code: BULK-SAVE You can use it to get the following discount: Order 25+ proxies and get 10% OFF of the total; Order 50+ proxies and get 15% OFF of the total amount; Order 100+ proxies and get 20% OFF total amount; We remind you that regular discounts on proxy packs also apply, and this promo code also gives you the opportunity to get an additional discount on proxy purchases. The promo code is valid till 15.05.2024 included. 🛒 Sincerely, Proxy-Seller.

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Forex News & Analysis

Murrey Math Lines 13.05.2024 (EURUSD, GBPUSD) EURUSD, “Euro vs US Dollar” EURUSD quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI is testing the resistance line. In this situation, the price is expected to break the 4/8 (1.0772) level and decline to the support at 3/8 (1.0620). The scenario might be cancelled by surpassing the 5/8 (1.0864) level, which might lead to a trend reversal, pushing the pair up to the 6/8 (1.0986) resistance level. On M15, a breakout of the VoltyChannel lower line will increase the probability of a price decline. GBPUSD, “Great Britain Pound vs US Dollar” GBPUSD quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI has rebounded from the resistance line. In this situation, the price is expected to break below the 2/8 (1.2451) level and fall to the support at 1/8 (1.2329). The scenario could be cancelled by surpassing the 3/8 (1.2573) level, which might lead to a trend reversal, propelling the pair to the 4/8 (1.2695) resistance level. Read more - Murrey Math Lines (EURUSD, GBPUSD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Forex News & Analysis

NZD is declining. Overview for 13.05.2024 The New Zealand dollar, paired with the US dollar, is retreating. The current NZDUSD exchange rate stands at 0.6008. The position of the US dollar has stabilised, once again exerting pressure on the NZD. The market focus is shifting to the US inflation statistics, which are scheduled for release this week. The Reserve Bank of New Zealand will hold its meeting next week, with the interest rate expected to remain at 5.5% per annum. The RBNZ intends to maintain its restrictive monetary policy until there are more concrete indications that inflation is approaching the designated 2% target. Overall, the RBNZ's position aligns with the global agenda: monitoring prices, recording economic slowdown facts, and keeping its finger on the pulse to intervene at the right moment. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

official Market Update by Solidecn.com

Solid ECN ✔️ replied to Solid ECN ✔️'s topic in Forex News & Analysis

WTI Crude Drops Below $78, Eyes on OPEC Solid ECN – WTI crude futures experienced a significant decline, dropping below $78 per barrel this Monday. This downward trend extended from last week when oil prices fell sharply by more than 1%. The drop is largely attributed to growing concerns about demand, influenced by economic indicators and policy signals from the U.S. Economic Signals Affect Oil Demand Recent statements by U.S. Federal Reserve officials suggest that high interest rates might persist, potentially slowing economic growth and reducing oil demand. This speculation is supported by a notable decrease in U.S. consumer confidence reported last Friday, signaling an economic slowdown. Additionally, increases in U.S. gasoline and distillate inventories ahead of the summer imply weaker-than-expected demand. Looking Ahead: OPEC's Next Moves Investors are now focusing on OPEC's policy meeting scheduled for early June. There is widespread anticipation that OPEC may continue its supply cuts into the latter half of the year, potentially influencing future market dynamics. -

Resmedindia joined the community

-

official NPBFX - npbfx.com

Antony_NPBFX replied to Antony_NPBFX's topic in Forex Brokers [Reviews & Updates]

Nvidia Corp.: technical analysis 13.05.2024 Good afternoon, dear forum visitors! NPBFX offers the latest release of analytics on Nvidia Corp. for a better understanding of the current market situation and more efficient trading. Shares of Nvidia Corp., an American giant in the development of video graphics processors, are trading in a corrective trend at 898.00. On the daily chart, the price is correcting above the resistance line of the downward channel 870.00–720.00. On the four-hour chart, the probability of continued growth is high, and the key “bullish” level is the year’s high of 956.00, on the way to which there are several resistance levels, for example, the current high of 921.00. If the quotes consolidate below the support level of 850.00, downward dynamics may develop but the likelihood is low. Technical indicators maintain a buy signal: fast EMA on the Alligator indicator move away from the signal line, keeping the fluctuation range wide, and the AO histogram forms corrective bars above the transition level. Trading tips Long positions may be opened after the price rises and consolidates above 921.00, with the target at 1000.00. Stop loss – 900.00. Implementation period: 7 days or more. Short positions may be opened after the price declines and consolidates below 870.00, with the target at 788.00. Stop loss – 900.00. Use more opportunities of the NPBFX analytical portal: E-book If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more. You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website. If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist. Use the current recommendations of analysts on Nvidia Corp. and trade efficiently with NPBFX. -

Greed is very dangerous for the Forex traders.

maspluto replied to Brendan Hill's topic in Forex Discussions & Help

The ability to analyze has a significant impact on our success in forex trading. That's why it's crucial to continuously develop our analytical skills, so that we can accurately analyze the market and benefit together with Tickmill as our broker. -

🚀 Unlock Your Earnning Potential with AI Guidelines! 🚀

maspluto replied to MIchel Kalib's topic in Forex Discussions & Help

Nowadays, there are many convenient ways to learn about forex trading. Traders can watch tutorials on YouTube, participate in forex forums, or take advantage of educational resources provided by brokers like Tickmill. By doing so, I can deepen my understanding and knowledge of forex trading. -

Uncontrolled emotions can make it difficult for traders to execute their trades effectively. That's why at Tickmill, I strive to control my emotions as much as possible. This way, trading can be more focused and directed.

-

Forex trading is a highly profitable business when understood and mastered correctly. That's why it's important for us to study and comprehend it, so that we can eventually master all its workings correctly with Tickmill as our broker.

-

Failure or loss is a common occurrence in forex trading. Every trader experiences it at some point. However, we shouldn't give up easily; instead, we should conduct evaluations so that future trading with Tickmill can be improved.

-

When A Good Strategy Is Losing Money – Part 1

maspluto replied to ⭐ analyst75's topic in Forex Discussions & Help

Greed will only lead traders to incur significant losses. That's why I always adhere to discipline and maintain emotional control, ensuring that trading with Tickmill is more focused and directed. -

The risks in forex trading are indeed very high, but they are proportional to the potentially significant profits. That's why at Tickmill, I always implement stop loss and take profit strategies. This way, I can execute trades comfortably and safely.

-

Success in forex cannot be achieved instantly and easily. Everything requires process and time. Therefore, it's advisable for traders to increase their learning and develop all that they have, so that they can grow and consistently gain profits in the future.