All Activity

- Past hour

-

kevinDgarza joined the community

-

BroPush partners who send traffic to a direct link have the ability to send postbacks to a third-party tracker and advertising network. By adding a subid to the link in the postback field, you can transmit the following parameters: network name (name), source ID (publisher), click ID (clickid). Clickid transmits a successful subscription. The cost is not transmitted since the system operates on a RevShare model. Here's an example of a postback: Different trackers have different postback settings and may use different brackets for sub - single [ ] or double [[ ]] - or {} or []. If you have any questions about setup, feel free to contact our technical support team. — BroPush.com is a system for monetizing traffic with push notifications. RevShare 80-97% — profits are 30% higher than competitors. 24/7 tech support: Skype Telegram WhatsApp Facebook Telegram Channel Telegram Chat

-

Traders should reduce the risk

Fin_Trader replied to Nilde Lucchese's topic in Forex Discussions & Help

Risk control has always been important when trading. To do this, it is better to trade with a small leverage, control the lot size in transactions according to your deposit size and use stop losses in trading. -

official Quppy.com - All in one solution

Quppy replied to Quppy's topic in Crypt Payments & Wallets [Reviews & Updates]

According to our customers - it is a typical share of crypto payments for most businesses that don’t lean heavily into the crypto audience. -

It is better to choose a broker based on a long time on the market, the best trading conditions, minimal spreads or commissions and instant execution. Due to these conditions, I chose fxopen. This makes it possible to trade Forex profitably and comfortably and not be afraid for your investments.

-

What is the best forex trading robot available today?

Fin_Trader replied to Salman1's topic in Forex Discussions & Help

The best Forex advisor may be the one that can be made using the algorithm of your proven manual trading strategy. Other people's robots are unlikely to help you earn money when you know nothing about them, do not understand their algorithm, and cannot program and configure them. -

official Daily Market Analysis From Forexmart.eu

KostiaForexMart replied to Andrea FXMart's topic in Forex News & Analysis

Growth continues: Wall Street in green for third day in a row American stock indices ended trading higher on Monday, marking their third consecutive positive session. Investors are once again raising hopes that the Federal Reserve may cut interest rates this year. Global stock indicators also rose amid optimism about a likely rate cut. At the same time, the Japanese yen weakened against the dollar after a sharp rise last week associated with the proposed currency intervention. Expectations for US central bank rate cuts fell during the year due to more persistent inflation. Some investors began to fear that a rate cut would not materialize at all, sending markets tumbling in April. However, Friday's data showed that U.S. job growth slowed more than expected in April. That eased pressure on the Federal Reserve, making it less likely that rates would remain high for long. Combined with an unexpectedly positive corporate earnings season, this has given investors fresh momentum in recent sessions. Last week, the Fed signaled it was willing to consider cutting interest rates but wanted to make sure inflation was falling sustainably before making that decision. Fed officials repeated that statement Monday. Richmond Fed President Thomas Barkin said the current level of interest rates should slow the economy enough to bring inflation back to the central bank's 2% target. However, a strong labor market provides time to wait. Traders now expect the Fed to cut rates by 46 basis points by the end of 2024, with the first cut forecast in September or November, according to rate probability app LSEG. Stocks on both sides of the Atlantic, as well as in Asia, rose. The US labor market report on Friday was softer than expected, leading to renewed bets that the Federal Reserve will ease monetary policy as early as September. The dollar index, which measures the US currency's exchange rate against six major trading partners, fell for the fourth session in a row. It comes after Friday's data showed the weakest job growth since October, allaying fears that the Fed could raise rates again. However, the outlook for inflation remains uncertain as the market hopes interest rates will be restrictive enough to slow the economy and reduce the rate of price increases, Conger said. The Dow Jones Industrial Average rose 176.59 points, or 0.46%, to 38,852.27. The S&P 500 added 52.95 points, or 1.03%, to 5,180.74. The Nasdaq Composite Index rose 192.92 points, or 1.19%, to 16,349.25. Most sectors of the S&P 500 index ended trading on a positive note. The energy sector was one of the top gainers, thanks in part to U.S. natural gas futures hitting their highest level in 14 weeks. Chipmaker shares were broadly higher on Monday, including Arm Holdings, which added 5.2% ahead of this week's earnings release. Micron Technology (MU.O) shares rose 4.7% after Baird upgraded the stock. Advanced Micro Devices (AMD.O) and Super Micro Computer (SMCI.O) also rose 3.4% and 6.1%, respectively, regaining ground lost after last week's disappointing earnings. Paramount Global (PARA.O) shares rose 3.1% after exclusive talks with Skydance Media ended without a deal, allowing a special committee to consider offers from other bidders. Tyson Foods (TSN.N) shares fell 5.7% despite beating Wall Street's second-quarter profit expectations as the company warned of pressure on consumers from persistent inflation. At the same time, shares of Spirit Airlines (SAVE.N) fell 9.7% to a record low after weak guidance for second-quarter earnings. The S&P 500 posted 29 new 52-week highs and 2 new lows, while the Nasdaq recorded 150 new highs and 54 new lows. In Europe, the cross-regional STOXX 600 index (.STOXX) rose 0.53%. It comes amid signs the European Central Bank is confident of cutting rates as euro zone inflation continues to slow, three ECB policy makers said. Philip Lane, Gediminas Simkus and Boris Vujicic said inflation and growth data supported their belief that eurozone inflation, which stood at 2.4% in April, would fall to the central bank's 2% target by the middle of next year. of the year. The MSCI World Shares Index (.MIWD00000PUS) rose 0.50% to close at 1,066.73, its highest level since June 2022. Markets in the UK and Japan were closed due to holidays. The dollar index was down 0.07% at 105.10, lifting the euro 0.07% to $1.0766. Goldman Sachs raised its 2024 earnings per share growth forecast for companies in the STOXX 600 Index (.STOXX) to 6% from 3%. The bank noted that a 10% annual rise in Brent oil prices adds about 2.5 percentage points to annual earnings per share growth, and a 10% decline in the euro/dollar exchange rate adds about the same. Treasury yields fell as investors weighed in on sluggish job creation last week, bolstering views that the U.S. economy is not overheated and will not be hampered by rate cuts. The yield on the 10-year U.S. Treasury note fell 1.3 basis points to 4.487% from 4.5% late Friday. Traders now expect the Fed to cut rates by 43 basis points by year-end, with the first cut likely to come in September, according to rate probability app LSEG. Traders have cut their expectations to one cut in recent weeks due to signs of persistent inflation. Oil prices rose after Saudi Arabia raised June crude oil prices for most regions. In addition, the unlikely prospect of a quick ceasefire in the Gaza Strip has revived fears of renewed fighting between Hamas and Israeli forces. U.S. crude rose 37 cents to $78.48 a barrel and Brent crude rose 37 cents to $83.33 a barrel. MSCI's index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) hit its highest level since February 2023, adding 0.66%, while the blue-chip China index (.CSI300) rose 1.5%. Hong Kong's Hang Seng Index (.HSI) rose 4.7% last week, posting its longest daily winning streak since 2018. The index closed 0.55% higher on Monday. Elsewhere, traders remain wary of potential yen volatility following past suspicions that Japanese authorities would intervene to stem the currency's sharp decline. Tokyo is believed to have spent more than 9 trillion yen ($59 billion) to prop up its currency last week, pushing the yen from a 34-year low of 160.245 to about a one-month high of 151.86 per dollar, according to the Bank of Japan. within a week. On Monday, the yen gave up some of its ground and was last trading at 153.95 per dollar, representing a decline of 0.63%. Gold prices rose amid a weakening dollar. US gold futures for June delivery rose 0.9% to $2,331.20 an ounce. Bitcoin added 0.65% to $63,343.00, while Ethereum was down 1.2% to $3,077.3. - Today

-

Being part of the Blockchain4Youth program has been an incredible experience for me. The knowledge and insights shared about blockchain technology and Web3 have been truly eye-opening and impactful. Getting hands-on experience through coding workshops and hackathons really solidified my understanding. But what made it even more valuable was the opportunity to connect with like-minded peers from around the world who share my passion for this space. I'm so grateful to have been part of this amazing initiative that is empowering youth like myself to be at the forefront of blockchain innovation.

-

Interesting! I came across some news today about the launch of a new DeFi token called $MODE. Launched today, May 7th, 2024, $MODE is the native token of the Mode network. Intrigued, I decided to explore what Mode has to offer. It appears to be a Layer-2 blockchain specifically designed for Decentralized Finance (DeFi) applications. This technology suggests faster transaction processing and potentially lower fees compared to the Ethereum mainnet, which could address some of the common pain points in DeFi. What truly piqued my interest is Mode's approach to incentivizing network growth. Their system reportedly rewards both developers and users for their contributions. This collaborative model fosters participation and could lead to a more robust and engaged community. Notably, the Mode network itself launched its mainnet just a few months ago in January 2024. Also, It's important to mention that there's a listing for $MODE on the Bitget cryptocurrency exchange, an exchange ranking within the top 5 of exchanges, on the 7th of May which should bring a good development price wise. Overall, the launch of the $MODE token and the functionalities of the Mode network itself present an interesting proposition within the DeFi landscape. The focus on speed, affordability, and a user-centric reward system is certainly noteworthy. We also can't ignore the core features of Mode and its commitment to community development. As always, conducting your own research is essential before making any investment decisions. This information is for informational purposes only and should not be interpreted as financial advice. However, the emergence of $MODE and the Mode network is certainly worth keeping an eye on to see how they evolve within the DeFi space.

-

official Market Update by Solidecn.com

Solid ECN ✔️ replied to Solid ECN ✔️'s topic in Forex News & Analysis

USDMXN - Banxico Rate Decision Looms Solid ECN—The Mexican peso has shown remarkable resilience. It is trading at approximately 16.8 per USD, a significant recovery from its five-month low of 17.2 recorded on April 25th. This improvement is largely due to a weakened U.S. dollar, spurred by increasing indications that the Federal Reserve might implement two rate cuts later this year. Contributing factors include moderated job growth and a rise in the U.S. unemployment rate in April, alongside Federal Reserve Chair Powell’s recent dismissal of potential rate hikes. Economic Indicators and Policy Outlook Amidst these currency shifts, Mexico’s central bank, Banxico, is expected to maintain its interest rate at 11% on May 9th, holding steady after a reduction in March. However, emerging economic data could spark discussions among Banxico’s Governing Council members about possible policy changes. The Mexican economy showed signs of acceleration, expanding by 0.2% in the first quarter of 2024, outpacing the previous quarter’s growth and surpassing market expectations. Additionally, business confidence in Mexico is robust, remaining near an 11-year high, although inflation exceeds 4%. -

Rivian Stock Goes High as Q1 Report Anticipation Mounts Being a newcomer within a very long-established and somewhat traditional global industry is not easy. The automotive industry is a case in point. It has been over 139 years since Karl Benz managed to successfully produce the first motorised vehicle, and since then, huge global conglomerates have built economies of scale to compete against each other fiercely in every corner of the world whilst evolving gradually rather than taking a revolutionary position. Suddenly, in 2014, the now infamous Elon Musk came from outside the traditional manufacturing or automotive sectors and disrupted an age-old, highly polished, and well-established industry to the extent that even Mercedes Benz, the company that invented the car all those years ago, has begun making electric cars to compete with those introduced by Elon Musk's Tesla company. More recently, some even newer names have entered the electric vehicle arena, some of which listed their stock on public exchanges in North America with high-value listings despite little or no market share, having done so via controversial SPAC 'blank check' companies toward an audience which, for many, would have heard the names of such companies for the first time. One such firm is Rivian Automotive, which listed its stock on the NASDAQ exchange in November 2021 at a price of $78 per share. Since then, Rivian, whose main product is an electric pickup truck, has been incredibly volatile, trading at a lot less than $10 per share more recently, but had been fluctuating around $25 in December. As the New York trading session came to a close yesterday, Rivian stock was among the top risers on FXOpen's TickTrader platform, concluding the trading day at $10.31 per share according to FXOpen pricing. TO VIEW THE FULL ANALYSIS, VISIT THE FXOPEN BLOG Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

OliviaErin joined the community

-

Victor joined the community

-

Alishmartin joined the community

-

official Market Update by Solidecn.com

Solid ECN ✔️ replied to Solid ECN ✔️'s topic in Forex News & Analysis

USDCAD - Canadian Dollar Surge Solid ECN – The Canadian dollar recently hit a high of 1.36 USD, marking its strongest position since early April. This rise comes amid a widespread weakening of the U.S. dollar, driven by disappointing labor statistics from the U.S. The data showed only 175,000 new jobs created in April, well below the anticipated 243,000. This underperformance, coupled with slower wage growth and a slight increase in unemployment, suggests that the Federal Reserve may cut rates as early as September. Economic Indicators in Canada In contrast, economic signals from Canada also hint at an upcoming rate adjustment, with several key indicators underscoring potential economic challenges. The Manufacturing PMI fell to 49.4, indicating continued contraction in factory activity for the twelfth consecutive month. Furthermore, the Canadian economy's growth was a modest 0.2% in February, with expectations of stagnation in March, signaling a possible earlier rate cut by the Bank of Canada. -

The US Labour Market Is Slowing Down. How Could This Impact Major Currency Pair Pricing? A weak employment report in the US contributed to a sharp pullback in major currency pairs, but it hasn't led to a full change in major trends yet. For instance, nonfarm payroll figures showed that: The number of new jobs came in at 173K, compared to the forecast of 238K. Average monthly wages decreased by 0.2% against an expected 0.3% increase. Unemployment rose to 3.9% from 3.8%. Following the slowdown in job growth, investors will eagerly await inflation data. If the figures meet or exceed expert forecasts, expectations for a rate cut by the US regulator could increase. GBP/USD According to technical analysis of the GBP/USD pair using the "chaos" system, we are seeing a corrective pullback after the formation of a reversal bar on April 22. Attention should be paid to price behaviour around 1.2520-1.2500. If the price rebounds from this range, it could strengthen towards 1.2640-1.2600. A drop below support at the entwined alligator lines may lead to a retest of the recent low around 1.2300. Key events of the week include: Today at 11:30 (GMT +3:00), publication of data on business activity index in the UK construction sector for April. Thursday at 14:00 (GMT +3:00), Bank of England meeting and decision on the GBP base interest rate. TO VIEW THE FULL ANALYSIS, VISIT THE FXOPEN BLOG Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Gold can indeed be donated to help alleviate poverty. While it may not be as commonly donated as cash or other forms of assistance, gold holds significant value and can be a valuable asset for those in need. Donating gold can provide a more stable and long-term solution for individuals or communities facing financial hardships. Gold donations can be used in various ways to support the poor. For example, gold can be sold or pawned to provide immediate financial assistance for basic needs such as food, shelter, or healthcare. Additionally, gold can be invested or saved for the future, helping to build financial resilience and security for individuals or families. Furthermore, gold donations can also be utilized to support community development projects or initiatives aimed at empowering marginalized groups. For instance, gold can be used to fund education programs, vocational training, or small business initiatives, providing opportunities for economic empowerment and self-sufficiency. Overall, while donating gold for the poor may not be as common as other forms of assistance, it can still make a significant impact in improving the lives of those in need, offering a valuable resource that can be utilized to address both immediate and long-term challenges associated with poverty.

-

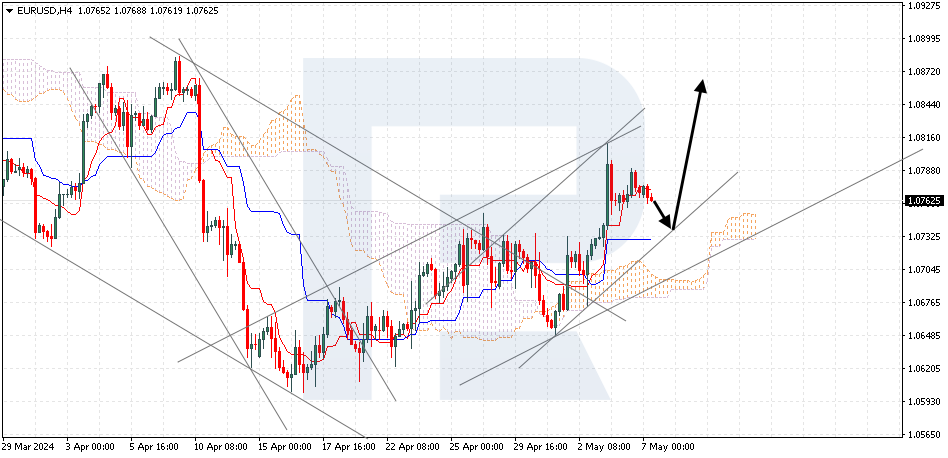

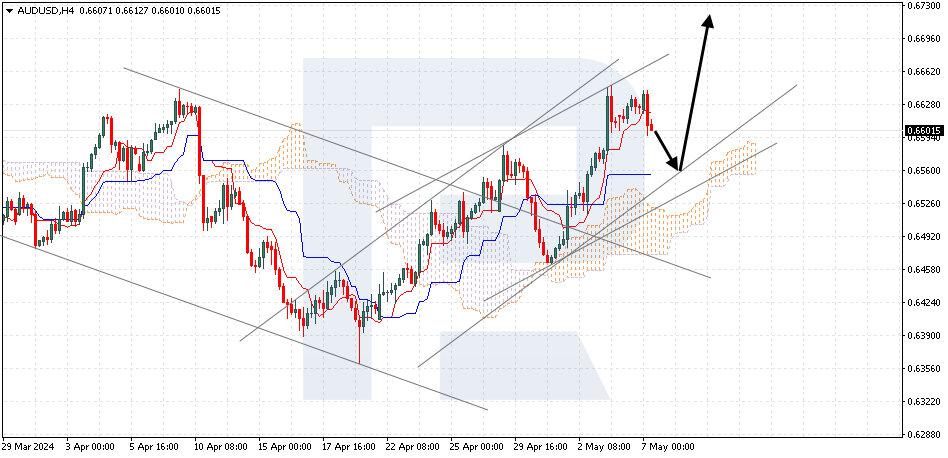

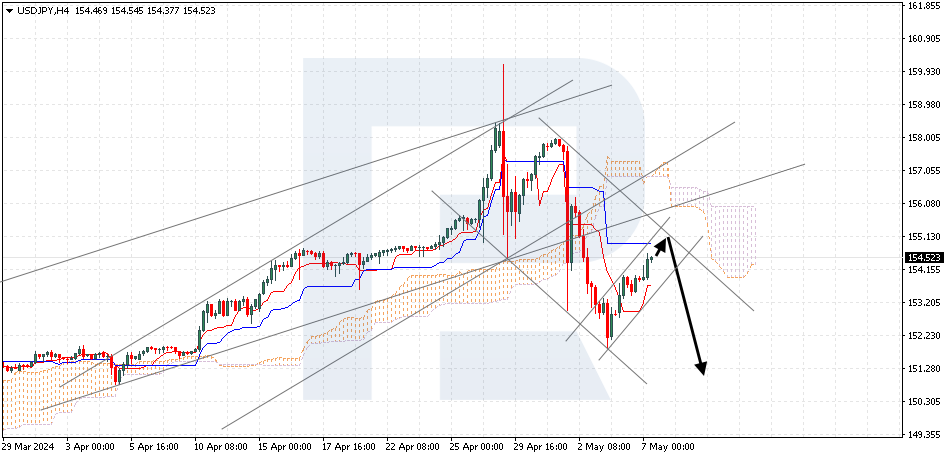

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Forex News & Analysis

Ichimoku Cloud Analysis 07.05.2024 (EURUSD, AUDUSD, USDJPY) EURUSD, “Euro vs US Dollar” EURUSD is testing the signal lines of the indicator. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 1.0745 is expected, followed by a rise to 1.0875. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 1.0660, indicating a further decline to 1.0575. AUDUSD, "Australian Dollar vs US Dollar" AUDUSD is declining following a rebound from the resistance level. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 0.6565 is expected, followed by a rise to 0.6725. An additional signal confirming the rise will be a rebound from the lower boundary of the ascending channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 0.6445, which will indicate a further decline to 0.6355. USDJPY, “US Dollar vs Japanese Yen” USDJPY is rising within a bearish channel. The pair is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Kijun-Sen line at 155.15 is expected, followed by a decline to 151.25. An additional signal confirming the decline could be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud, with the price finding a foothold above 157.10, which will indicate further growth to 158.05. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the bullish channel, with the price securing below 153.05. Read more - Ichimoku Cloud Analysis (EURUSD, AUDUSD, USDJPY) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Forex News & Analysis

JPY declines again. Overview for 07.05.2024 The Japanese yen, paired with the US dollar, resumes its decline. The current USDJPY exchange rate stands at 154.54. After a series of strengthening moves, the yen came under pressure again amid the statements of a leading monetary policymaker Masato Kanda that the government is ready to fight speculative movements of exchange rates. However, Kanda left unanswered the question of interventions last week. The yen rose by 5.2% from its 34-year lows, with strong growth observed during three sessions but then stopping. As the Bank of Japan data shows, at least 60 billion USD was spent to protect the yen. If these were targeted interventions, it is no wonder that the yen resumed its decline once they were over. Fundamental indicators remain negative for the JPY – the difference between the Bank of Japan and the US Federal Reserve approaches is profound. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

official Nordfx broker: news, weekly Analytics

Stan NordFX replied to Stan NordFX's topic in General Crypto Discussions & [Ann]

NordFX Named Best ECN/STP Forex Broker 2024 NordFX received its first award nearly 15 years ago, back in 2010. Since then, it has been honoured with more than 70 professional prizes and titles for achievements and innovations across various sectors of the financial industry. However, only once before, in 2015, were NordFX's merits in organizing ECN trading specifically recognized. Now, the esteemed international online portal FXDailyInfo has once again acknowledged the company as the Best ECN/STP Forex Broker. FXDailyInfo is one of the leading resources providing daily news and analysis on the financial markets, including broker reviews, educational materials, and other useful information for traders. The portal also annually recognizes the best representatives of the financial industry with its awards. Winners of the FXDailyinfo Awards are determined through open voting by visitors to the website, which makes these awards particularly valuable as they objectively reflect the opinion of the professional community. This time, the high rating was given for the services NordFX offers its clients on Zero accounts on popular platforms such as MetaTrader 4 and 5. A key feature here is direct access to interbank liquidity. The Electronic Communication Network (ECN) used on MT4 Zero and MT5 Zero accounts directs trader orders directly to liquidity providers, bypassing any additional intermediation. This reduces order processing time and provides the opportunity to trade at the most favourable prices with minimal commissions and spreads. On most popular pairs such as EUR/USD, GBP/USD, and USD/JPY, typical spreads are 0 pips. In addition to currency pairs, traders can also conduct transactions with cryptocurrencies, stocks, and exchange indexes, as well as oil, gas, and precious metals on these accounts. Notably, the spread for the gold pair XAU/USD is also zero. This pair is particularly favored by traders in NordFX's top three, largely thanks to which they were able to earn an impressive total of nearly $2.5 million USD in the previous year, 2023. Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited. #eurusd #gbpusd #usdjpy #btcusd #ethusd #ltcusd #xrpusd #forex #forex_example #signals #cryptocurrencies #bitcoin #stock_market https://nordfx.com/ -

I'm not admin !!! https://quantguard.ai/ Online Date 2024-05-06 Investment Plans: 0.35%- 1% Daily for 30 Business Days (Principal Included) Min Spend $200 Min Withdraw $10 Referral Commission 5 levels: 5% - 2% - 1% - 1% Withdrawal Type Manual Payment Method: BTC,LTC,ETH,USDT TRC20/ERC20 Licensed GoldCoders' Script SSL Let's Encrypt DDoS Protection by Ddos-Guard About Us: + Additional Info Plans Details: Our deposit proof : https://tronscan.org/#/transaction/e6758ddf...8631332926e80ec The admin paid $2000 insurance for lifetime --- read our insurance rules here .

-

UK100 Analysis: Stock Market Optimistic Ahead of Bank of England News On Monday, the UK observed a bank holiday for May Day, and on Tuesday, the stock market demonstrated accumulated optimism. The FTSE index (UK100) today surpassed the 8300 mark. Additionally: → The opening occurred with a bullish gap; → On the daily chart of UK100, today the RSI indicator is in overbought territory, unseen since the beginning of 2023. One of the significant drivers of bullish sentiments could be considered events on Thursday – at 14:00 GMT+3, news from the Bank of England is expected: market participants will learn about the decision on the interest rate, followed by a press conference. As Econoday writes: → A decision to cut interest rates is unlikely at Thursday's meeting, with autumn being seen as the most probable period for a 0.25-point rate cut from the current level of 5.25 points. → Members of the rate-setting committee are concerned that inflation is slowing down too slowly. However, the trend is in the right direction, and the Bank of England has already stated that the 2 percent target does not necessarily need to be reached before interest rates are lowered. Perhaps the anticipation of signals for monetary policy easing instils confidence in the bulls, but how sustainable can the current growth be? TO VIEW THE FULL ANALYSIS, VISIT FXOPEN BLOG Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.