All Activity

- Past hour

- Today

-

OliviaErin joined the community

-

Victor joined the community

-

Alishmartin joined the community

-

official Market Update by Solidecn.com

Solid ECN ✔️ replied to Solid ECN ✔️'s topic in Forex News & Analysis

USDCAD - Canadian Dollar Surge Solid ECN – The Canadian dollar recently hit a high of 1.36 USD, marking its strongest position since early April. This rise comes amid a widespread weakening of the U.S. dollar, driven by disappointing labor statistics from the U.S. The data showed only 175,000 new jobs created in April, well below the anticipated 243,000. This underperformance, coupled with slower wage growth and a slight increase in unemployment, suggests that the Federal Reserve may cut rates as early as September. Economic Indicators in Canada In contrast, economic signals from Canada also hint at an upcoming rate adjustment, with several key indicators underscoring potential economic challenges. The Manufacturing PMI fell to 49.4, indicating continued contraction in factory activity for the twelfth consecutive month. Furthermore, the Canadian economy's growth was a modest 0.2% in February, with expectations of stagnation in March, signaling a possible earlier rate cut by the Bank of Canada. -

The US Labour Market Is Slowing Down. How Could This Impact Major Currency Pair Pricing? A weak employment report in the US contributed to a sharp pullback in major currency pairs, but it hasn't led to a full change in major trends yet. For instance, nonfarm payroll figures showed that: The number of new jobs came in at 173K, compared to the forecast of 238K. Average monthly wages decreased by 0.2% against an expected 0.3% increase. Unemployment rose to 3.9% from 3.8%. Following the slowdown in job growth, investors will eagerly await inflation data. If the figures meet or exceed expert forecasts, expectations for a rate cut by the US regulator could increase. GBP/USD According to technical analysis of the GBP/USD pair using the "chaos" system, we are seeing a corrective pullback after the formation of a reversal bar on April 22. Attention should be paid to price behaviour around 1.2520-1.2500. If the price rebounds from this range, it could strengthen towards 1.2640-1.2600. A drop below support at the entwined alligator lines may lead to a retest of the recent low around 1.2300. Key events of the week include: Today at 11:30 (GMT +3:00), publication of data on business activity index in the UK construction sector for April. Thursday at 14:00 (GMT +3:00), Bank of England meeting and decision on the GBP base interest rate. TO VIEW THE FULL ANALYSIS, VISIT THE FXOPEN BLOG Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Gold can indeed be donated to help alleviate poverty. While it may not be as commonly donated as cash or other forms of assistance, gold holds significant value and can be a valuable asset for those in need. Donating gold can provide a more stable and long-term solution for individuals or communities facing financial hardships. Gold donations can be used in various ways to support the poor. For example, gold can be sold or pawned to provide immediate financial assistance for basic needs such as food, shelter, or healthcare. Additionally, gold can be invested or saved for the future, helping to build financial resilience and security for individuals or families. Furthermore, gold donations can also be utilized to support community development projects or initiatives aimed at empowering marginalized groups. For instance, gold can be used to fund education programs, vocational training, or small business initiatives, providing opportunities for economic empowerment and self-sufficiency. Overall, while donating gold for the poor may not be as common as other forms of assistance, it can still make a significant impact in improving the lives of those in need, offering a valuable resource that can be utilized to address both immediate and long-term challenges associated with poverty.

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Forex News & Analysis

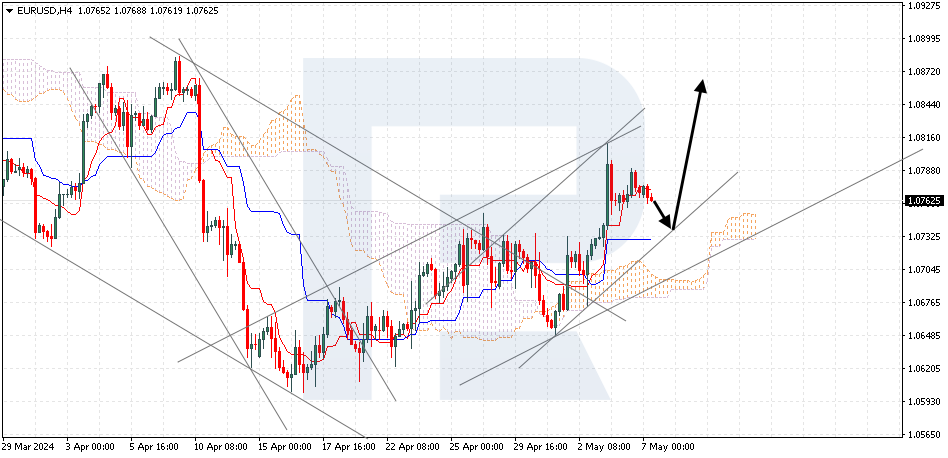

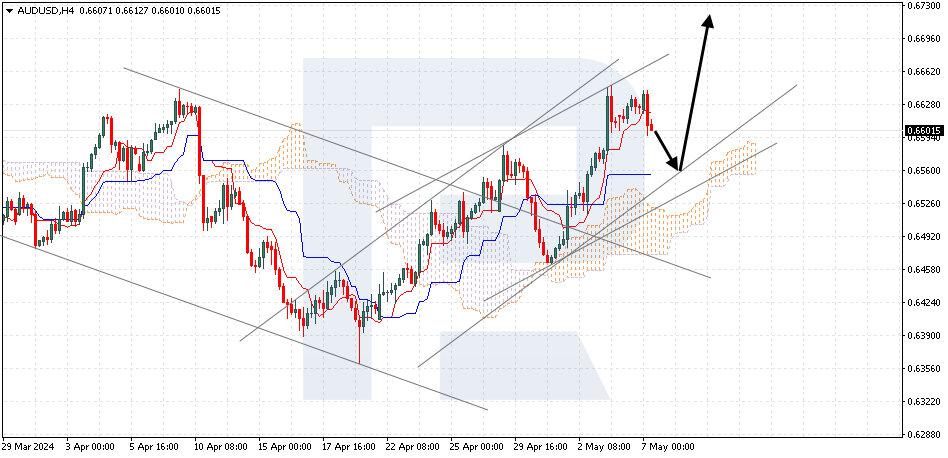

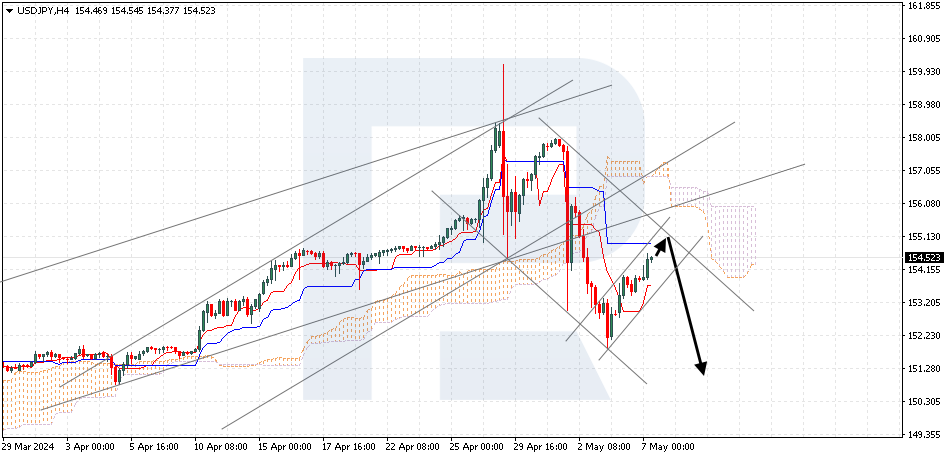

Ichimoku Cloud Analysis 07.05.2024 (EURUSD, AUDUSD, USDJPY) EURUSD, “Euro vs US Dollar” EURUSD is testing the signal lines of the indicator. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 1.0745 is expected, followed by a rise to 1.0875. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 1.0660, indicating a further decline to 1.0575. AUDUSD, "Australian Dollar vs US Dollar" AUDUSD is declining following a rebound from the resistance level. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 0.6565 is expected, followed by a rise to 0.6725. An additional signal confirming the rise will be a rebound from the lower boundary of the ascending channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 0.6445, which will indicate a further decline to 0.6355. USDJPY, “US Dollar vs Japanese Yen” USDJPY is rising within a bearish channel. The pair is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Kijun-Sen line at 155.15 is expected, followed by a decline to 151.25. An additional signal confirming the decline could be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud, with the price finding a foothold above 157.10, which will indicate further growth to 158.05. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the bullish channel, with the price securing below 153.05. Read more - Ichimoku Cloud Analysis (EURUSD, AUDUSD, USDJPY) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Forex News & Analysis

JPY declines again. Overview for 07.05.2024 The Japanese yen, paired with the US dollar, resumes its decline. The current USDJPY exchange rate stands at 154.54. After a series of strengthening moves, the yen came under pressure again amid the statements of a leading monetary policymaker Masato Kanda that the government is ready to fight speculative movements of exchange rates. However, Kanda left unanswered the question of interventions last week. The yen rose by 5.2% from its 34-year lows, with strong growth observed during three sessions but then stopping. As the Bank of Japan data shows, at least 60 billion USD was spent to protect the yen. If these were targeted interventions, it is no wonder that the yen resumed its decline once they were over. Fundamental indicators remain negative for the JPY – the difference between the Bank of Japan and the US Federal Reserve approaches is profound. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

official Nordfx broker: news, weekly Analytics

Stan NordFX replied to Stan NordFX's topic in General Crypto Discussions & [Ann]

NordFX Named Best ECN/STP Forex Broker 2024 NordFX received its first award nearly 15 years ago, back in 2010. Since then, it has been honoured with more than 70 professional prizes and titles for achievements and innovations across various sectors of the financial industry. However, only once before, in 2015, were NordFX's merits in organizing ECN trading specifically recognized. Now, the esteemed international online portal FXDailyInfo has once again acknowledged the company as the Best ECN/STP Forex Broker. FXDailyInfo is one of the leading resources providing daily news and analysis on the financial markets, including broker reviews, educational materials, and other useful information for traders. The portal also annually recognizes the best representatives of the financial industry with its awards. Winners of the FXDailyinfo Awards are determined through open voting by visitors to the website, which makes these awards particularly valuable as they objectively reflect the opinion of the professional community. This time, the high rating was given for the services NordFX offers its clients on Zero accounts on popular platforms such as MetaTrader 4 and 5. A key feature here is direct access to interbank liquidity. The Electronic Communication Network (ECN) used on MT4 Zero and MT5 Zero accounts directs trader orders directly to liquidity providers, bypassing any additional intermediation. This reduces order processing time and provides the opportunity to trade at the most favourable prices with minimal commissions and spreads. On most popular pairs such as EUR/USD, GBP/USD, and USD/JPY, typical spreads are 0 pips. In addition to currency pairs, traders can also conduct transactions with cryptocurrencies, stocks, and exchange indexes, as well as oil, gas, and precious metals on these accounts. Notably, the spread for the gold pair XAU/USD is also zero. This pair is particularly favored by traders in NordFX's top three, largely thanks to which they were able to earn an impressive total of nearly $2.5 million USD in the previous year, 2023. Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited. #eurusd #gbpusd #usdjpy #btcusd #ethusd #ltcusd #xrpusd #forex #forex_example #signals #cryptocurrencies #bitcoin #stock_market https://nordfx.com/ -

I'm not admin !!! https://quantguard.ai/ Online Date 2024-05-06 Investment Plans: 0.35%- 1% Daily for 30 Business Days (Principal Included) Min Spend $200 Min Withdraw $10 Referral Commission 5 levels: 5% - 2% - 1% - 1% Withdrawal Type Manual Payment Method: BTC,LTC,ETH,USDT TRC20/ERC20 Licensed GoldCoders' Script SSL Let's Encrypt DDoS Protection by Ddos-Guard About Us: + Additional Info Plans Details: Our deposit proof : https://tronscan.org/#/transaction/e6758ddf...8631332926e80ec The admin paid $2000 insurance for lifetime --- read our insurance rules here .

-

UK100 Analysis: Stock Market Optimistic Ahead of Bank of England News On Monday, the UK observed a bank holiday for May Day, and on Tuesday, the stock market demonstrated accumulated optimism. The FTSE index (UK100) today surpassed the 8300 mark. Additionally: → The opening occurred with a bullish gap; → On the daily chart of UK100, today the RSI indicator is in overbought territory, unseen since the beginning of 2023. One of the significant drivers of bullish sentiments could be considered events on Thursday – at 14:00 GMT+3, news from the Bank of England is expected: market participants will learn about the decision on the interest rate, followed by a press conference. As Econoday writes: → A decision to cut interest rates is unlikely at Thursday's meeting, with autumn being seen as the most probable period for a 0.25-point rate cut from the current level of 5.25 points. → Members of the rate-setting committee are concerned that inflation is slowing down too slowly. However, the trend is in the right direction, and the Bank of England has already stated that the 2 percent target does not necessarily need to be reached before interest rates are lowered. Perhaps the anticipation of signals for monetary policy easing instils confidence in the bulls, but how sustainable can the current growth be? TO VIEW THE FULL ANALYSIS, VISIT FXOPEN BLOG Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Web hosting works as long as you pay for it 🙂 It's simple. You can choose a payment period of 1,3,6,12 months and use it as long as you want and need it https://alexhost.com/shared-hosting/ https://alexhost.com/litespeed/ What do you mean by “change of management” We have the same team of professionals 🙂 https://alexhost.com/about/

-

360Proxy.com - Proxy Provider

BBBill replied to BBBill's topic in Affiliate Marketing Tools & Resources

360Proxy is a residential IP provider with the highest purity in the world.🔆🔆 It has 100% real residential IP resources, covering more than 190 countries and regions, 80M+ massive resources to meet user needs Powerful web crawling capabilities to provide users with first-class services and complete anonymity and security. Various proxy types can meet different needs. Supports GB/IP two billing methods, giving users the greatest choice. 🥰Click to see more: https://www.360proxy.com/register.html?utm-keyword=?Proxy -

official Market Update by Solidecn.com

Solid ECN ✔️ replied to Solid ECN ✔️'s topic in Forex News & Analysis

NZ Dollar Dips Amid US Stability Solid ECN – The New Zealand dollar recently fell to $0.6 against a stabilizing US dollar. This shift came as fresh economic indicators suggested a potential cut in US interest rates later this year. Concurrently, the Kiwi mirrored the Australian dollar's downturn after the Reserve Bank of Australia opted to maintain its current interest rates, adopting a less aggressive stance than many anticipated. Geopolitical Influences Investors closely monitor the Middle East, where recent developments could impact global markets. Following Hamas's acceptance of a ceasefire in Gaza proposed by mediators, tensions remain as Israel did not agree to the terms, continuing military operations in Rafah and planning further negotiations. New Zealand's Economic Outlook In New Zealand, despite market expectations leaning towards an interest rate cut by October, fueled by recent weaker employment figures, the central bank has indicated it might hold off on easing monetary policy until 2025. This decision is based on persistently high inflation rates in the year's first quarter. -

Exmasters-Mark changed their profile photo

-

Buy Unlimited Reseller Hosting With Free WHMCS, Save Upto 45%!

LibertyVPS replied to HostPoco's topic in Hosting & Domains

What payment plans are available? For example, if you sign up for a two-year subscription term, do you need to pay that full amount upfront or is it divided into increments? -

LibertyVPS changed their profile photo

-

EURCHF Technical Analysis for 07.05.2024 Time Zone: GMT +3 Time Frame: 4 Hours (H4) Fundamental Analysis: Recent economic data releases across Europe provide a mixed yet cautiously optimistic outlook for the Euro, influencing the EUR/CHF exchange rate. The performance in service sectors across major European economies has generally exceeded expectations: Spanish Services PMI reported at 56.2, slightly above the forecast and previous figures, suggesting robustness in Spain's service sector. Italian Services PMI showed a minor dip to 54.3 from 54.6, indicating a slight contraction but still reflecting overall sectoral strength. French Final Services PMI marked a significant improvement to 51.3 against a forecast of 50.5, pointing to expansion contrary to expectations. German Final Services PMI and the overall Eurozone Final Services PMI both posted solid figures, indicating ongoing resilience in the services sector despite broader economic challenges. Additionally, the Sentix Investor Confidence index improved to -3.6, better than both the previous -5.9 and the expected -4.8, suggesting a recovery in investor sentiment within the Eurozone. Price Action: The EUR/CHF pair has responded to these economic indicators with a notable trend on the H4 chart. After a recent pullback to the 38.2% Fibonacci retracement level, the pair is potentially setting up for a bullish reversal. This technical posture is supported by the RSI which remains neutral, hinting at neither overbought nor oversold conditions, thus supporting a potential for price recovery. The combination of stronger-than-expected service sector performance and improving investor confidence could underpin the Euro's strength against the Swiss Franc. Technically, the EUR/CHF pair seems primed for a bullish movement, suggesting an opportune moment for traders to consider long positions, especially as the market sentiment aligns with these fundamental improvements on EURCHF forex pair. Key Technical Indicators: RSI Indicator: The Relative Strength Index is currently stabilizing around the mid-line, suggesting balanced market conditions without overt signals of overbought or oversold states. This stabilization is particularly noteworthy after the price touched the Fibonacci retracement, indicating that the pullback may have provided sufficient consolidation for a new bullish momentum. Fibonacci Retracement: The 38.2% level has served as a strong support, bouncing the price into what could be an early phase of a bullish trend. The adherence to this Fibonacci level enhances the reliability of the bullish outlook in the near term. Support and Resistance: Support: The recent lows around 0.97270 provide a short-term support level. Resistance: The recent high near 0.97900 and 0.98228 serve as resistance levels. Conclusion and Consideration: Given the current technical setup, the EUR/CHF is poised for potential upward movement, affirming the forex live analysis and bullish trend forecast. Traders should consider the strength at the 38.2% Fibonacci level as a solid basis for potential entries, with expectations of upward momentum as market conditions align with technical indicators. As always, it's advisable to employ prudent risk management strategies, keeping an eye on any shifts in market sentiment or unexpected geopolitical events that could influence forex dynamics. Disclaimer: The provided analysis is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions. FxGlory 07.05.2024

.thumb.png.d69ff11508ef929ec712a98b4c1f943a.png)