⤴️-Paid Ad- TGF approve this banner. Add your banner here.🔥

Search the Community

Showing results for tags 'technical analysis'.

-

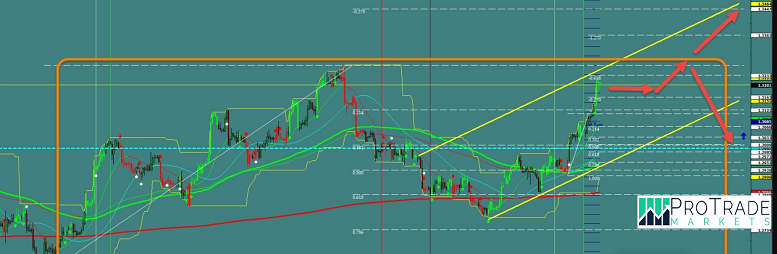

GBP/AUD Getting Bounch (ATR) 128 Pips Started at 1.6530 and moved back to the double top at 1.6600 with an overall target at 1.6749

-

- technical analysis

- forex analysis

-

(and 2 more)

Tagged with:

-

Direct Emmanuel Macron, an ace EU ex-lender and past economy serve won French races. US. Nonfarm Payrolls and Unemployment Rate solid better than expected. The dollar is still in clear oversold go. The Federal Reserve is up 'til now foreseen that would raise advance charges again this year with the rate climb inclined to occur in September rather than June (dependent upon labor financial circumstances and a bolstered returned to 2% swelling). The U.S. charge change package will streamline the appraisal system, cut down rates, and make the structure more appealing, regardless, the association is up 'til now working with the House and the Senate to agree with indisputable purposes of intrigue. Retail Sales and German Unemployment Change again better than Expected (the last avows a positive 7-month strike). Eurozone GDP preliminary release stable at 1.7%, of course. Spanish improvement + Eurozone Inflation Data (CPI, Preliminary) higher than Expected bolstered Euro. Moreover, Manufacturing PMI is keeping the ordinary pace. Of course, U.S. Gross local item (Preliminary) lower than the longing however incredibly the Gross Domestic Product (GDP) Price Index QoQ (which measures the annualized change in the cost of all stock and ventures fused into the gross family unit thing, so it is the broadest inflationary indicator) was higher than foreseen. As we wrote in the past commentaries, we expect a union around 1.095, with possible retests of 1.085 locales. By and by we are in clear overbought more than 1.09 and we envision that this situation will be reviewed before basic U.S. data, with a believability to get lower and retest our Second Support in range 1.078. Get in touch here for more Daily Technical Analysis

- 1 reply

-

- technical analysis

- daily analysis

-

(and 1 more)

Tagged with:

-

Technical analysis of EUR/GBP dated 12.11.2012 As it was mentioned in the previous analysis of this currency pair dated 01.10.2012, there was the possibility of the price ascend which finally the price passed the supportive level of 0.79230. The price during its ascend has recorded the resistance level of 0.81633 which is one of the important resistance level. The price during its downfall from the mentioned top price by reaching to the ascending trend line (the formation of the third point of ascending trend line) has been stopped from more descend and has recorded the bottom price of 0.795587 by closing of the daily ascending candle on 9th day. Stoch indicator shows the possibility of ascend (also the divergence mode with the price) in daily time frame according to the next cycle. In 4H time frame as it is obvious in the picture below , there is Wolfe Wave ascending pattern and warns the ascending of price up to the goal line . By the formation and completion of the 5th point of this pattern, there is a warning for ascend and increase of price. The price during its ascend from the 5th point of Wolfe wave pattern and reaching to the descending trend line is not able to ascend more and with the formation of two Shooting Star candlestick patterns has formed the top price of 0.80070 . Breaking of the descending trend line is the first important warning for ascending in this currency pair.

-

FX - EURO The EURO closed higher on Friday and the midrange close sets the stage for a steady opening on Monday. Stochastics and the RSI are neutral to bullish signalling that sideways to higher prices are possible nearterm. If it renews the rally off July's low, the 50% retracement level of this year's decline crossing is the next upside target. Closes below the 20day moving average crossing would confirm an end to the rally off July's low. FX - YEN The YEN closed higher on Friday and the midrange close sets the stage for a steady opening when Monday's night session begins trading. Stochastics and the RSI are bearish signalling that additional gains are possible. If it extends the decline off August's high, the 87% retracement level of this year's rally crossing is the next downside target. Closes above last Thursday's high would open the door for a possible test of August's high crossing. FX - SWISS FRANC The SWISS FRANC closed lower on Friday and the midrange close sets the stage for a steady opening when Monday's night session begins trading. Stochastics and the RSI remain neutral to bearish signalling that sideways to lower prices are possible nearterm. If it extends the decline off July's high, the reaction low crossing is the next downside target. Closes above the 20day moving average crossing would confirm that a shortterm bottom has been posted. FX - STERLING STERLING closed lower on Friday and the midrange close sets the stage for a steady opening when Monday's night session begins trading. Stochastics and the RSI remain neutral to bullish signalling that sideways to higher prices are possible nearterm. If it extends the rally off June's low, April's high crossing is the next upside target. Closes below the 20day moving average crossing would confirm that a shortterm top has been posted.

-

- market commentary

- forex market

-

(and 2 more)

Tagged with:

-

USD / JPY Daily Outlook August 16, 2012 Break of 79.13 resistance indicates that a decrease of 80.61 finish. Upside and the daily bias is targeting 79.96 first and 80.61 the next. The current development does not guarantee a decrease of 84.17 has been flipped. Therefore, it will be careful in topping signals around 80.61 . And, break of 78.59 indicates the completion of a rebound. USD / CHF Daily Outlook August 16, 2012 USD / CHF Daily neutral bias (sideway) for now. Short-term outlook remains bearish as long as 0.9898 minor resistance has not been touched. Decline from 0.9971 will continue. Below 0.9656 will target 38.2% retracement of the 0.8930-0.9971 at 0.9573 . Break there will have more bearish implications, and should target the 0.9420 support. However, break of 0.9898 would target 0.9971 and possibly above. EUR / USD Daily Outlook August 16, 2012 EUR / USD still below 1.2443 daily and neutral bias. As long as 1.2133 support has not been touched, rebound from 1.2042 will continue. Above 1.2443 will target resistance is 1.2747 (50% retracement of 1.3486 to 1.2042 at 1.2764). However, break of 1.2133 would confirm the rebound from 1.2042 is complete. In such case, EUR / USD re-test at level 1.2000 . GBP / USD Daily Outlook August 16, 2012 GBP / USD is still in the range of 1.5489/5767 and daily bias remains neutral. On the condition of upside, break of resistance 1.5767/77 will confirm resumption of rebound from 1.5268 and target 1.5901 / 6 (61.8% retracement of 1.6300 to 1.5268 at 1.5906 and 100% of the projected one, 5268 to 1.5777 from 1.5392 at 1.5901). However, break of 1.5489 support will bring a reduction in support to 1.5392 . Read More

-

- bonus

- metatrader

-

(and 4 more)

Tagged with: