⤴️-Paid Ad- TGF approve this banner. Add your banner here.🔥

Search the Community

Showing results for tags 'forex analysis'.

-

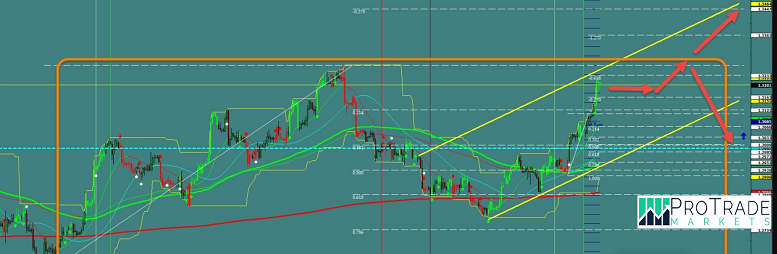

Investors bought the British pound again, and the GBP/USD moved towards the 1.3607 resistance level yesterday before settling around 1.3550 as of this writing. Sterling's move in the Forex market came as rapid re-quotes of future interest rate hikes in the Bank of England are nearing completion and current exchange rates are more in line with expectations of a rate hike in February.

-

- gbp usd signal

- forex analysis

-

(and 1 more)

Tagged with:

-

AUD/NZD on track to extend losses below 1.0450 on RBNZ rate hike expectations AUD/NZD has been under continuous selling pressure since June 14. The Aussie weigh down by the outbreak of the highly contagious Delta variant and mixed economic data. Kiwi remains grounded on RBNZ upcoming policy meeting on rate hikes hope. AUD/NZD retreats after printing some initial gains on Monday in the Asian session. The pair has been in continuous downside momentum for above one month, after making a high at 1.0824 on June 14. At the time of writing, AUD/NZD is trading at 1.0454, up 0.27% for the day. A combination of factors weighing the performance of the Australian dollar against its counterpart. The Aussie remained pressurized on the extension of lockdown amid renewed COVID-19 jitters and downbeat economic data at home. Market participants remained cautious amid the worsening domestic coronavirus situation. New South Wales state recorded a nearly 20% jump in fresh coronavirus infections overnight. Australia’s New Home sales plunge 20.5% on monthly basis. It is worth noting that S&P 500 Futures were trading at 4,452 with 0.22% losses. On the other hand, Kiwi gained on the better COVID-19 situation. There were no fresh cases recorded in the community as per the Ministry of Health. The Reserve Bank of New Zealand (RBNZ) is expected to announce interest rates hike in its upcoming policy meeting. The recent Kiwi’s gains were trimmed after not so enthusiastic data.

-

What’s next? – USDJPY 21.03.18 The dollar was trading 0.05 percent lower vs the Japanese yen at 106.47 as of 04:40 GMT on Wednesday, with the dollar easing as Fed’s monetary event approaches. The US dollar index, which measures the greenback against six major currencies, was trading 0.10 percent lower at 89.86 by the time of this writing. The Federal Reserve is expected to raise interest rates for the first time this year by 25 basis points, which would put the benchmark rate in a range between 1.50 and 1.75 percent. According to Fed funds CME Group’s FedWatch program, market players are currently pricing in a nearly 94 percent chance of a rate hike this week. It would be the first hike of 2018. Analysts have pointed out Fed’s interest rate hike has already been priced in, explaining a downward correction is likely once the official announcement is done. However, the dollar could extend gains if Jerome Powell opts for a more hawkish rhetoric. The US regulator has forecasted at least three rate moves for 2018. No relevant data was released on Tuesday. Ahead in the day, market players will be paying attention the release of existing home sales for February at 14:00 GMT and the interest rate decision for March as of 18:00 GMT. Investors will also carefully monitor a speech by Fed Chair Jerome Powell. #forex analysis

-

GBP/AUD Getting Bounch (ATR) 128 Pips Started at 1.6530 and moved back to the double top at 1.6600 with an overall target at 1.6749

-

- technical analysis

- forex analysis

-

(and 2 more)

Tagged with:

-

Vistabrokers CIF Ltd is an International Investment and Brokerage Company, registered in the European Union and licensed by the Cyprus Securities & Exchange Commission (190/13). The protection of Clients’ rights and interests are guaranteed by European Legislation, the Investors Compensation Fund and License requirements for Investment and Brokerage services providers. Vista Brokers is managed by financial market professionals with decades of experience in the financial industry. Through its business activities the Company’s management is guided by principles and approaches that center on aspects such as excellent customer service, innovation, fast and reliable execution. Other business criteria such as Equilibrium, Reputation, Responsibility, Leadership, Honesty, Partnership, Innovations, and Quality are those Company strives to fully achieve and comply with. The Company aims to be the Broker with a human face; an aspect which we will achieve via our personal and honest relation with our clients. Our mission is based on Philosophy & Evolution. Our Philosophy is to be the Broker with a human face – people working for people. And our Evolution is to open the doors for Investors to the world’s financial instruments through creating unique approaches & concepts in online trading. www.vistabrokers.com

- 604 replies

-

- forex analysis

- forex broker

- (and 4 more)

-

Usdjpy Supported Above 100 Yen, Sterling Hits New 2-Week High

Guest posted a topic in Forex News & Analysis

Market sentiment remains positive as it is still being characterized by the loose monetary policies of the world’s major central banks – Federal Reserve, European Central Bank and Bank of Japan. Last week, the Fed President nominee Janet Yellen signaled she will continue the Fed’s stimulus program, which helped keep risk appetite supported. Most major currency pairs traded in familiar ranges, with the riskier currencies holding on to gains from the risk rally produced at the end of last week. Sterling carved a new two-week high in Asia today, with GBPUSD hitting a session high of $1.6141, while the euro breached a key level of $1.3500, peaking at $1.3506 before steadying at $1.3490. The dollar/yen pair is the main currency in focus after it broke above the key psychological level of 100 yen last week. USDJPY eased back down today but found support at this level, after opening in Asian at 100.25 yen. The yen is expected to weaken further based on the Bank of Japan’s monetary easing policies. There are a couple of key releases from Japan this week, including trade balance and the BoJ meeting, both of which will be key drivers for the Japanese currency. Aussie was the biggest mover in Asia this morning, with AUDUSD rising to a high of $0.9412, gaining 0.4% percent.-

- forex analysis

- forex news

-

(and 1 more)

Tagged with:

.thumb.jpg.6f693d3dd8b54108c5a3bccfbf6130b9.jpg)